Why Leaving A Balance on Credit Cards Is A Bad Move

If you think leaving a balance on your credit cards will improve your FICO score, I'm afraid you've been gaslighted.

Originally published 3/17/22.

Not everyone was lucky enough to have my father for a parent.

Okay, that was too mushy and self-centered. I’ll try again.

When I was 20 or so, I got my first credit cards. I remember having two (who knows why) and deciding that I would use one for fun stuff and never pay it and use the other for things I had to buy like groceries and pay the minimum amount due.

I’m sure you can see where I’m going with this, and if you’ve read my financial content before, you’re probably clutching your pearls and yelling, “Pixie, what the hell?”

One day when I was on the phone with my dad, my life changed. I had told him what I was doing with my credit cards, and he almost had a heart attack. He told me that not only was paying the minimum balance due costing me money in what I can only imagine was 25% interest, but actively deciding not to pay one of the cards at all would send my credit score into the toilet faster than I could say “free shipping on Ebay.” It was 2004. Everyone was all over Ebay.

He explained that my credit score would determine whether I could open up accounts with utility companies without a deposit, would determine my rate for home and auto insurance, and would get me approved or not for an apartment or home mortgage.

I had no idea my desire to shop like it was a sport was going to ruin my future. I paid off both cards with my savings right after that call. Having been a college student relying on my parents for most of my expenses, I didn’t need or even know what an emergency fund was.

Carrying a balance increases your utilization ratio

The only time anyone should ever pay the minimum due on a credit card is when they have absolutely no money except what is needed for secured debts or things that can’t be paid by credit cards. This means typically rent or your mortgage. Anything you need where the provider doesn’t accept credit cards, and it’s something you need to stay alive and healthy. Put all of your liquid money toward survival and pay the minimum on your cards until your head is above water again.

When you carry a balance on your credit card, you’re showing that you are using more of your available credit. Ideally, you want to show that you’re using the smallest amount of your available credit, which would be 1%.

Anything over 30% will drop your score quite a bit.

If you are trying to establish a strong payment history, you can do so by making small purchases on your credit card and then paying the balance in full and on time each month. This practice keeps the card active and your balance well below your credit limit. It also demonstrates that you consistently manage debt well, which can help increase your credit scores. - Experian

This is also why when you purchase something using a large loan like a home or boat, you are told not to use your credit card for any large purchases until after closing. The lender will continue to check your credit to ensure you haven’t gone and done additional excessive spending. You want your utilization to remain low.

Credit utilization counts for 30% of your score

How much you use your available credit counts for 30% of your score. The only other factor that even comes close to this is payment history (at 35%), so paying on time is the biggest score factor. Having a high utilization ratio may imply that you are overextended financially, and lenders of any sort interpret this to mean that you are more likely to default on your obligations.

Bankrate also agrees carrying a balance affects your score negatively. How large the balance is will determine how much your score is lowered. Seemingly, leaving only a dollar or two as a balance will probably only affect your score by a few points.

You’re implying you’re broke

You’re also telling whoever is looking at your credit that you can’t afford to pay off your debts when they’re due. Your credit report doesn’t show how much money you have to spend when your cards are due. It just shows whether or not you have a balance when the billing period ends.

Your credit report implies how responsible you are when you borrow money. So, if you’re not paying off your cards in full, you’re telling whoever is looking at your report that you can’t afford to do that. They have no way of knowing otherwise, and as a result, your score itself will decrease.

Leaving a small balance on your cards might not deny your apartment application because the landlord can still see your proof of income, though as a former property manager, I can tell you that sometimes pay stubs are falsified, and landlords are scrutinizing applications more. If your FICO falls on the cusp of what your future landlord accepts, you could get denied just based on this, even if you have enough income to afford the apartment.

Only paying the minimum will cost a fortune

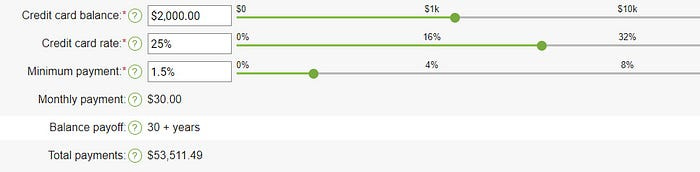

My original plan to only pay the minimum due on my cards would have had me in debt for 30 years. This calculator from Greenpath shows what my $2000 balance card (the one I’d decided never to pay off) would have cost me if I had an interest rate of 25%. I remember the minimum payment due, but I don’t remember the interest rate from a card I used 20 years ago. Considering now when my FICO is 832 I still have a card with a 25% interest rate, I don’t think it’s farfetched to assume this was my rate in 2004.

Guys, this total payment amount is about the same as my student loan. I could have earned a master’s degree with the money I was blowing on shopping.

You’re paying interest on the unpaid balance

But why would you leave a balance on your card at all when there is no benefit to doing so? You pay interest and it lowers your score.

I have a personal motto. It’s “I don’t pay interest. Interest pays me.” It basically means that my financial goals are such that I don’t ever want to pay interest for something when I don’t have to. And I want to earn interest on money in savings or invested in the stock market.

Interest is like a fee you have to pay to use your credit cards, a fee that you only pay if you’re clueless about how credit cards work. If you aren’t able to pay off what you owe, that’s one thing, and it can happen to anyone. If you are able to pay it off, and you’re leaving the balance there because you think it’s better for your credit, you are essentially passing up free money.

If you happen to have a zero-interest card and think you’re pulling a fast one on creditors, think again. If your balance is high, and you plan on only paying it off right before the interest rate kicks in, you’re telling lenders that your utilization rate is higher than what’s really the case. And as mentioned before, a high utilization will hurt your score.

I hope that now it’s easy to see why leaving a balance on your credit card not only hurts your score but also costs you money. There is never a situation in which it’s a good idea to leave a balance on your card.