Why Everyone Is Doing FIRE Wrong

A lot of people are talking about the FIRE movement (financial independence, retire early) but don't understand what they really need to do in order to retire early.

Originally published 10/17/21.

A lot of people are talking about the FIRE movement (financial independence, retire early) because—let’s face it—no one works because it’s fun for them. People are working longer than they used to, sometimes by full decades. When millennials were born, most of our grandparents had already been out of the work force since they were 50 or 55. Now Social Security’s full retirement age is 67 for anyone born after 1960—which is confusing because you get more money if you wait until 70. Like, hello, change the definition of what “full retirement age” actually means, dude.

I see a lot of videos on Youtube from CBNC Make It praising some millennial or Gen-Xer for retiring in their 40s or earlier. Quite frankly, I am surprised when people retire as early as their 50s like my parents did, but I guess that’s not as click-worthy as the 30- and 40-somethings retiring. Here’s why those influencers you see “retiring” early are all smoke and mirrors.

Not enough time investing

Part of what makes investing such a tried-and-true vehicle for retirement income is that when you begin investing early in life and continue to invest for several decades, you can easily earn enough to cover your living expenses in retirement. But time is the key.

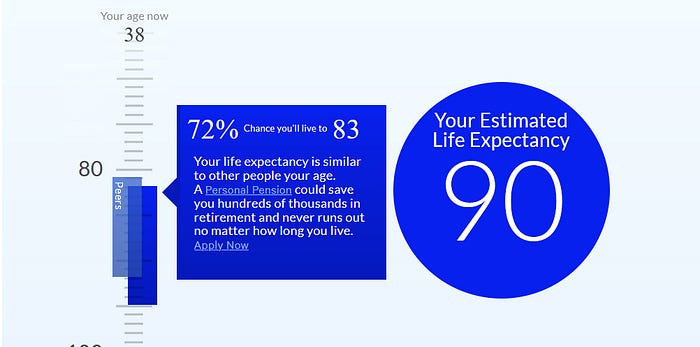

People who retire before they’re required to have a mammogram or prostate check haven’t put in enough time to cover their expenses over the long term. Their investments may seem large now, but when that amount is spread over the course of their remaining lifespan, they’re earning poverty levels of income. For reference, you should always calculate living at least until age 90. Unless you have a fatal disease, there is a huge chance you will be older than your parents were when they died.

Not moving investments into bonds

The biggest issue I see when influencers share their investments after achieving FIRE is that they never moved their funds from stocks into bonds. As we get closer to retirement age, we’re advised to fund stocks less and less and bonds much more. This is because unlike stocks (even index funds), bonds aren’t as volatile in the market, and they retain their value more. This is also why their return on investment is so low.

But none of these FIRE influencers have changed their investment strategy once they stopped working, so their funds are still 80% invested in risky stocks. And when (yes, not if but when) we have another recession, their stocks will dwindle down to far less than their original value, but the small percentage of bonds they hold won’t budge very much.

Without their stocks to cover their expenses, they’ll have to go back to work, likely after several years unemployed. And do you really want to be looking for a job in a crappy economy when everyone else is—with a huge employment gap to explain?

What they should do is sell their stocks 2-3 years before retiring and buy bonds instead. You want to hold an investment for at least a year before selling it so that you don’t have to pay capital gains tax on it, so this is an extra 5 or so years of planning that impatient FIRE people don’t consider.

They’re never really retired

For the record, every single CNBC Make It video or blog I have read about someone who achieved FIRE noted that the retired person was still working, usually as a Youtube influencer and likely earning more doing that than they did at their day job.

People, the definition of being retired is “having left one's job and ceased to work.” If you’re spending hours recording and editing and uploading Youtube videos and begging us to use your discount code for whatever sponsor is covering today’s video, then you are fucking working. Stop calling yourself retired; you just moved into a different line of work. People do it every day.

Guys, Social Security isn’t for us

One thing that I think I’ve accounted for that these other FIRE people haven’t is that we’re not going to be able to collect Social Security.

Now, I don’t want to scare anyone, but I kind of do as that’s typically my whole MO.

The Social Security Administration has a trust account that is currently paying benefits. The money in that account will be depleted in 2033. You were probably expecting to live longer than that, right?

Now, Social Security often claims “the system was never intended to cover all of your retirement needs.” But for many people, that’s exactly what it does. How many articles have you read admonishing Americans’ saving habits? Apparently almost 20% of people can’t afford a $400 emergency expense.

So, if we have bupkis in savings but can’t use Social Security to cover all of our retirement, we’re expected to cover most of it with our investments. And we’ve already pointed out that most people who retire early have risky investments that won’t cover them for 50 more years of being alive.

While Social Security is not expected to go away forever, if the trust does deplete, “Social Security law would cut benefit checks for retirees by about 20% across the board.” Which means that we’ll get less than expected. That puts a damper in your retirement calculations, doesn’t it?

And if they have no problem cutting benefits, who’s to say they won’t cut 100% of benefits for people who earned a certain amount of money while they worked? Is it that unrealistic to think that a few decades from now they’ll treat Social Security like welfare?

If that’s the case, there is a good chance no one who has enough invested that they think they can retire in their 40s will qualify for Social Security payments. And if receiving Social Security was part of your calculations for whether or not you could retire early, this is bad news for you.

Employment gaps are an issue

I think it’s unwise to plan to retire in your 40s or earlier and not expect to have to go back to work at some point in the future due to your investments not lasting as long as they could have. Maybe if you have six-figure inheritances from both parents, you could swing it.

But since this is such a new concept, it’s smarter to play it safe. You’ll probably have to go back to work if your investments take a dive or something comes up that makes you realize you don’t quite have the financial cushion you thought you did. You’re going to find that you’re not such a stellar job candidate if you’ve been out of work for 10+ years and are already old enough to have had a cemetery-themed birthday party.

Knowing your expenses 3 decades from now is impossible

I think it’s cute when people try to calculate their expenses for a life they don’t have yet. It makes sense to budget for this year or next year and even five years down the road. But why would you quit your job 3 decades before your retirement age using the budget you have now as your financial blueprint?

I didn’t know ten years ago what my mortgage was going to be now. I didn’t know how much I’d spend on vet bills. I didn’t even have an idea of how much money I’d be making. Hell, I couldn’t have predicted that I’d be living in Chicago with plans to move to Arizona soon either.

Using the information you have in your 30s or 40s to plan around the life you will have in your 80s is foolhardy. Unless you are budgeting for double your expenses and including inflation, there is no way you are going to get this number accurate, and you might run out of money before you run out of heartbeats.

People always assume they’ll spend less money in retirement. Maybe that’s true for people who have four kids still living at home. But people who are childfree and relatively healthy now should expect to spend more on healthcare in retirement. If you have maxed out your HSA for a while, kudos to you. You have a leg up.

Despite all this, I still want to retire earlier than I’d planned

I know I’m a bubble-burster. But it’s really just because I don’t want anyone to be shortchanged in retirement, and I’m an extreme planner. I’ve already got plans on where we’re going to live after this job that’s taking us to Arizona is over, and we haven’t even left Chicago yet.

Retiring before I turn 70 would be a dream. I don’t really expect it to happen just because I’m the type of person who thinks I need double what experts say I do. Experts don’t know my life! But if I happened to be able to retire completely and just volunteer or work on hobbies before I turn gray, that would be cool.

You keep working toward FIRE, but remember that these pitfalls are real, and you should plan for them accordingly. And don’t tell people you’re retired if you get non-investment income. I’ll even consider a landlord retired if they contract out all the management of their properties. Influencers are not.